Facts About Paul B Insurance Revealed

Wiki Article

The Buzz on Paul B Insurance

Table of ContentsA Biased View of Paul B InsuranceThe Definitive Guide for Paul B InsurancePaul B Insurance Can Be Fun For EveryoneThe Best Strategy To Use For Paul B InsurancePaul B Insurance Things To Know Before You Buy

The thought is that the money paid in cases over time will certainly be less than the overall costs gathered. You may seem like you're throwing cash out the home window if you never sue, however having piece of mind that you're covered on the occasion that you do endure a significant loss, can be worth its weight in gold.Visualize you pay $500 a year to guarantee your $200,000 home. You have ten years of making payments, and also you have actually made no cases. That comes out to $500 times ten years. This indicates you've paid $5,000 for house insurance coverage. You begin to question why you are paying a lot for nothing.

Since insurance coverage is based on spreading the threat among many individuals, it is the pooled money of all people spending for it that permits the business to build assets and cover insurance claims when they take place. Insurance policy is a company. It would certainly be good for the business to simply leave prices at the same degree all the time, the reality is that they have to make adequate money to cover all the possible claims their insurance holders might make.

6 Simple Techniques For Paul B Insurance

just how much they entered costs, they need to change their rates to earn money. Underwriting changes as well as rate boosts or decreases are based upon outcomes the insurance firm had in previous years. Relying on what firm you buy it from, you may be handling a captive agent. They market insurance policy from just one business.The frontline individuals you take care of when you purchase your insurance are the representatives as well as brokers that represent the insurance provider. They will clarify the kind of products they have. The restricted agent is a rep of just one insurer. They a familiar with that company's items or offerings, yet can not talk in the direction of various other business' policies, pricing, or product offerings.

The 9-Minute Rule for Paul B Insurance

The insurance you require differs based on where you are at in your life, what type of properties you have, as well as what your lengthy term objectives and duties are. That's why it is vital to make the effort to review what you want out of your plan with your representative.If you get a car loan to purchase a cars and truck, and also then something takes place to the auto, space insurance coverage will settle any kind of section of your explanation loan that typical vehicle insurance does not cover. Some loan providers require their consumers to bring gap insurance policy.

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

Getting The Paul B Insurance To Work

Life insurance coverage covers the life of the guaranteed person. Term life insurance covers you for a duration of time chosen at acquisition, such as 10, 20 or 30 years.Term life is prominent since it offers huge payouts at a reduced cost than permanent life. There are some variants of common term life insurance coverage policies.

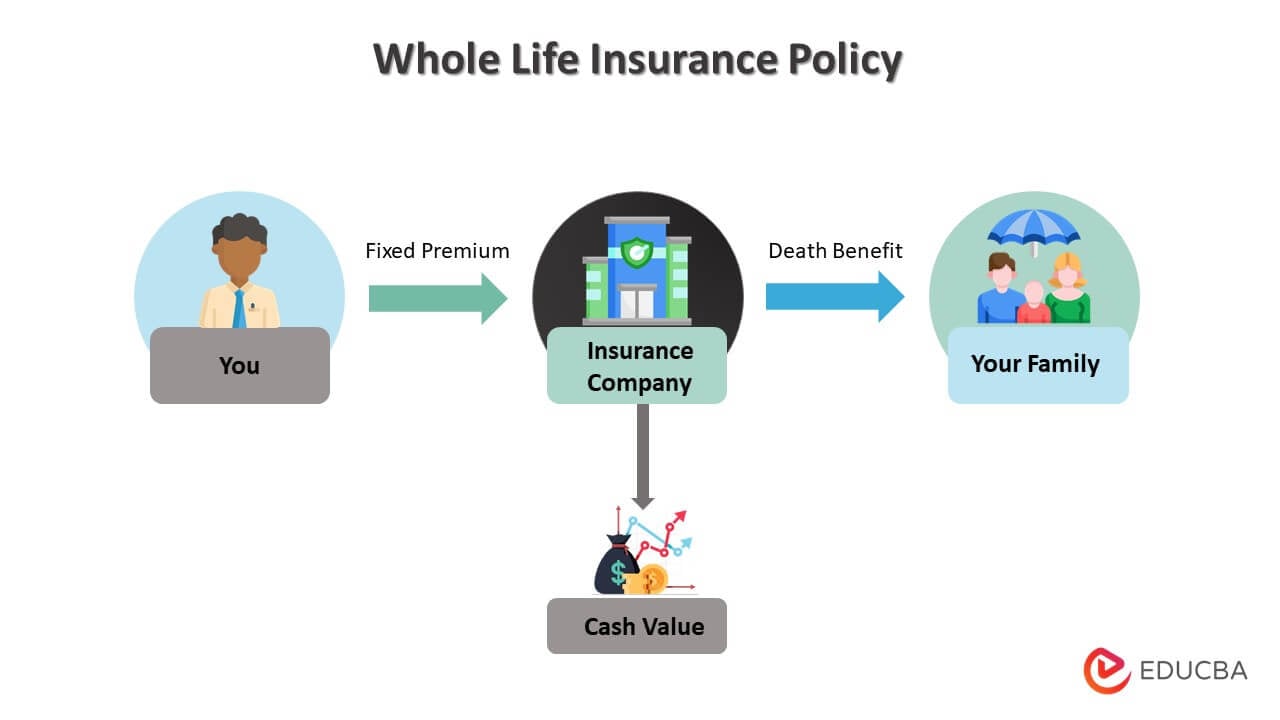

Permanent life insurance plans build cash worth as they age. The cash money worth of whole life insurance coverage policies expands at a set rate, while the cash worth within universal policies can fluctuate.

Little Known Facts About Paul B Insurance.

If you contrast typical life insurance coverage rates, you can see the difference. $500,000 of whole life protection for a healthy 30-year-old lady costs around $4,015 yearly, on standard. That exact same level of protection with a 20-year term life plan would set you back approximately concerning $188 every year, according to Quotacy, a brokerage company.Variable life is an additional permanent life insurance policy pop over to this web-site alternative. It's a different to whole life with a set payout.

Below are some life insurance essentials to assist you much better understand exactly how coverage works. Costs are the settlements you make to the insurance provider. For term life plans, these cover the price of your insurance and also management costs. With a long-term policy, you'll likewise be able to pay cash right into a cash-value account.

Report this wiki page